“The further up you go on the income statement, the more you learn about the business. The further down you go, the more you learn about the people who run the business.” — Geoff Gannon.

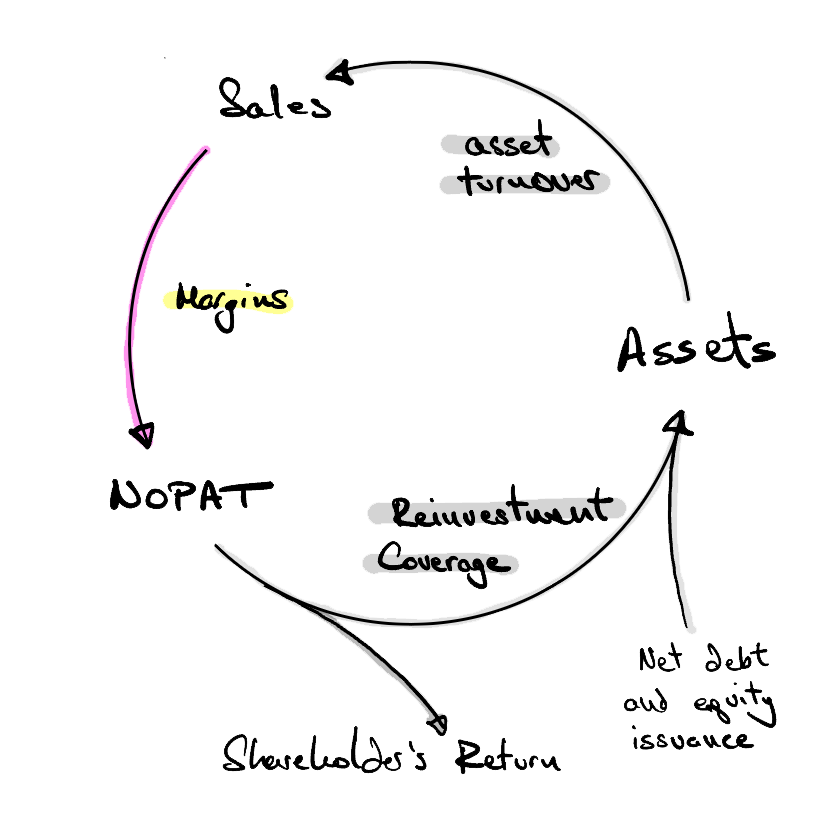

It all starts with that first item on the income statement: revenue. How does this business make money? And then, having made money, how does management turn it into profit? In this first post, we’ll break down the first stage of the business cycle for an airport—its operational efficiency. In a following post we’ll look at stages two and three.

What first drew us to this industry? As we’ll see below, it’s a highly regulated and highly complex business. The mandated cap on fees means there is limited upside to the stock. But there are advantages, too. For one, we can be sure demand for travel in 20 years will be higher than it is today. And the long duration of concessions means that operators have a virtual monopoly on arriving tourists.

On one side, the high dividend yield and predictability of the business positions airport stocks similarly to bonds. On the other, operators are essentially tasked with managing a shopping mall that benefits from a captive audience. This dual aspect creates the conditions for a compelling investment, so long as:

The stock is purchased at a reasonable price, as the limited potential for price appreciation emphasizes the importance of the initial investment cost;

The company boasts sufficient geographical diversification to mitigate risks associated with any change in governmental regulations or other more nefarious activities (like possible instances of corruption);

The business focuses on investing in airports that are poised to become key hubs for international tourism.

i. The Main Airport Operators

The airport operators discussed in this report are:

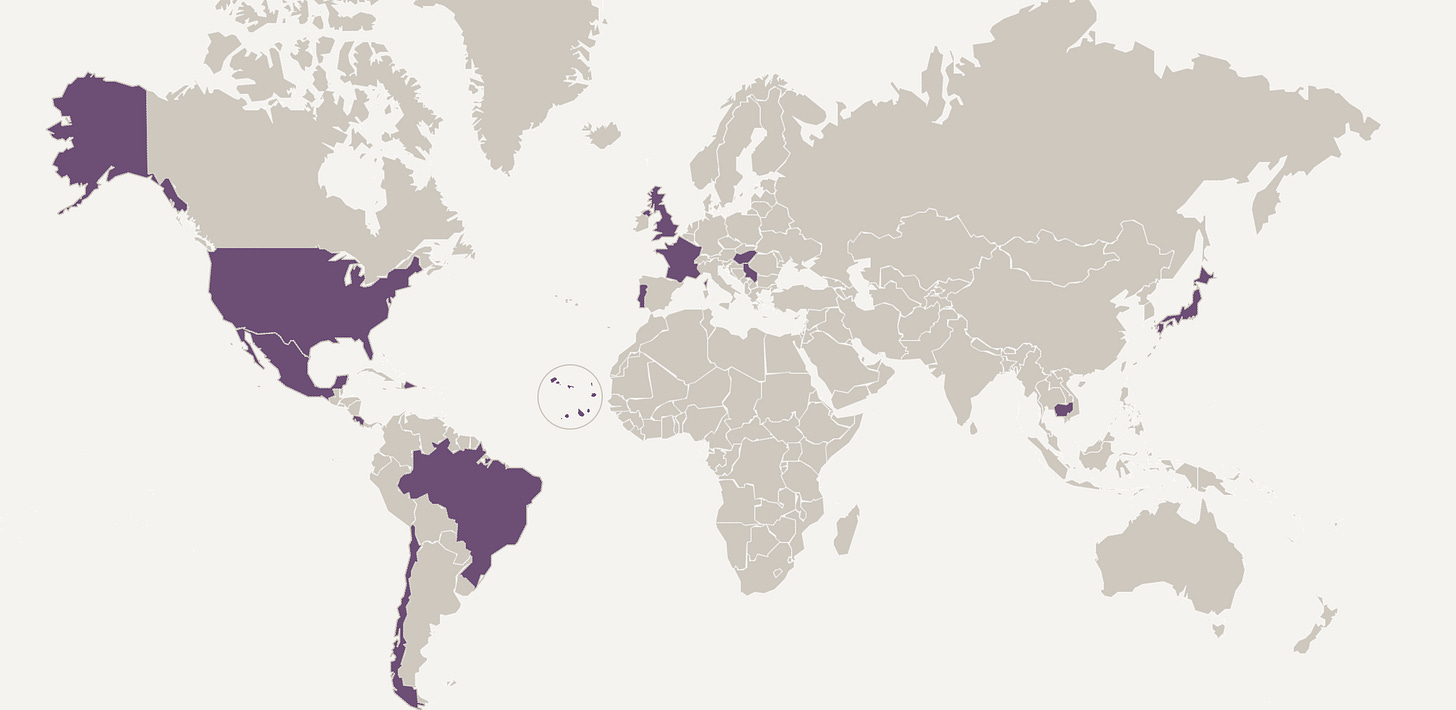

Vinci — operates 10 airports in Portugal, 3 in the UK, 13 in Mexico, 12 in France, 2 in Cambodia, 8 in Brazil, 3 in Japan, and 1 in Chile, among others.

Served a total of 200mm passengers in 2023 (excluding joint ventures).

Aéroports de Paris (ADP) — operates 2 airports in Paris, 1 in Chile (with Vinci), 1 in Jordan. Also owns a 46% stake in TAV Holdings (see below) and a 49% of GMR Airports (which operates 4 airports in India).

Served a total of 100mm passengers in 2023 (excluding joint ventures).

TAV Havalimanlari Holding (TAV) — operates 5 airports in Turkey, 1 in Kazakhstan, 2 in Georgia, 1 in Saudi Arabia, 2 in Tunisia, 2 in North Macedonia, 1 in Croatia.

Served a total of 95mm passengers in 2023.

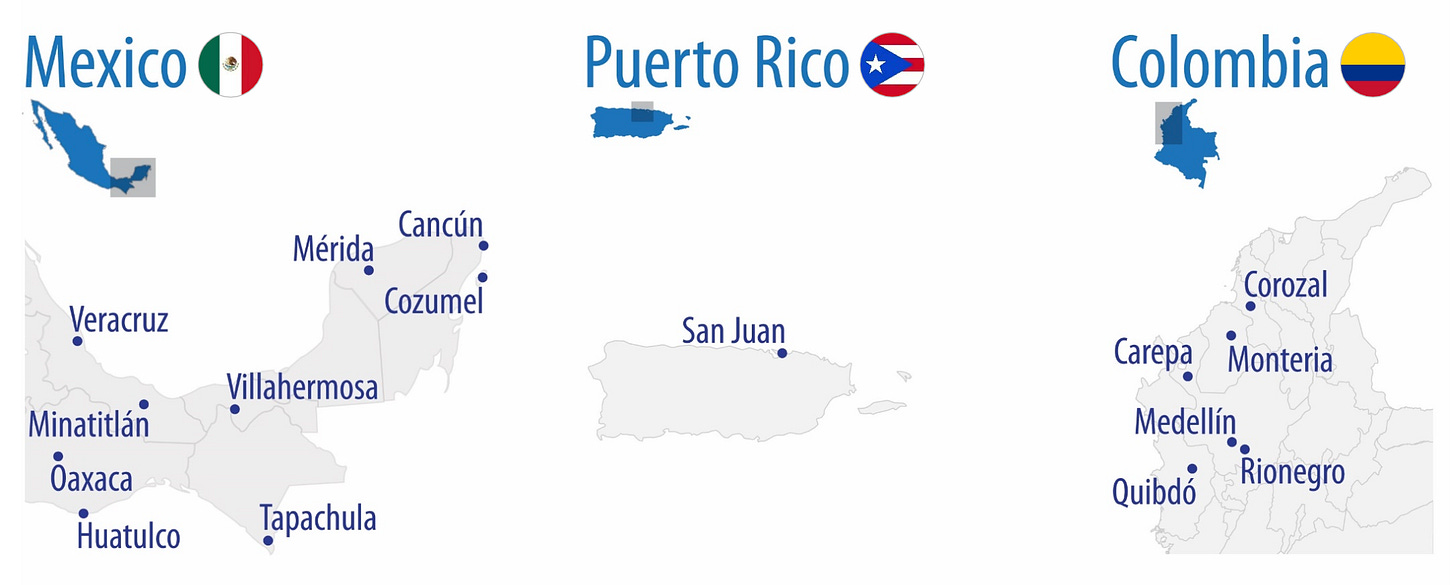

Grupo Aeroportuario del Sureste (ASUR) — operates 9 airports in Mexico, including Cancún and Oaxaca, 1 in Puerto Rico, and 6 in Columbia.

Served a total of 70mm passengers in 2023.

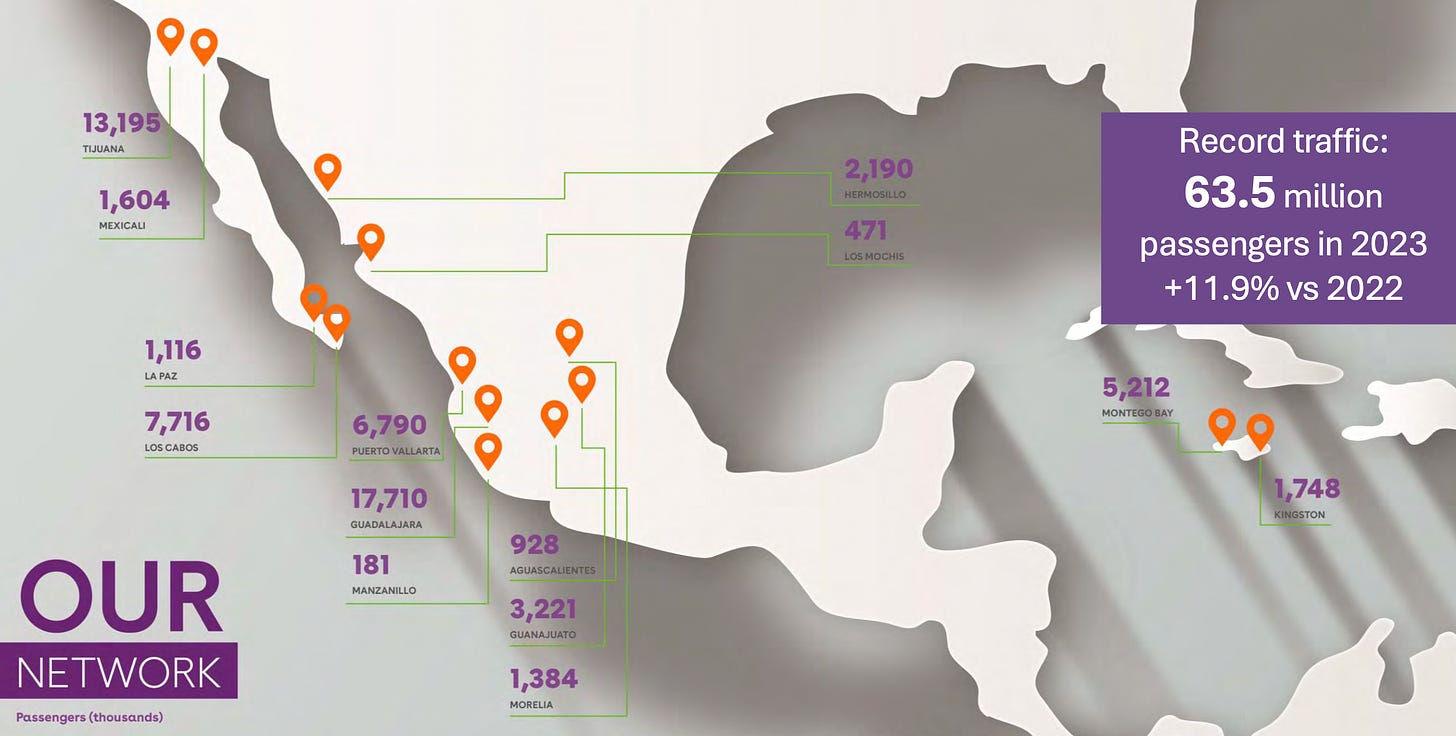

Grupo Aeroportuario del Pacífico (GAPB) — operates 12 airports in Mexico, including Guadalajara, Tijuana, Los Cabos, and Puerto Vallarta, and 2 in Jamaica.

Served a total of 64mm passengers in 2023.

AENA — operates 46 airports in Spain, 17 in Brazil, and 1 in the UK.

Served a total of 283mm passengers in 2023.

ii. Aeronautical Fees

When a plane touches down on the runway, a series of revenue-generating activities is set into motion that enrich the airport's coffers.

Firstly, government-mandated fees kick in. For each passenger aboard any domestic or international flight, the airport collects what are known as aeronautical fees from airlines, which include landing fees, terminal usage services, and other aviation-related charges. Typically, fees are a good deal higher for international passengers than for domestic ones—as much as 6x higher, according to Serkan Kaptan, CEO of TAV Holding.

As these tariffs are predetermined by authorities, they provide a steady income stream for the airport that is less susceptible to immediate market fluctuations. They are, however, still susceptible to the whims of whichever government is in power and are not, therefore, immune to broader economic trends or significant political changes that could impact the aviation sector in the long term.

There is also generally limited upside—governments will not approve an increase of the maximum allowance without commitments of fresh investments or improvements of airport infrastructure. In ADP’s case, tariffs cannot by law exceed the cost of services it provides, leaving it dependent on other sources of revenue for growth.

For operators subject to less stringent regulations, growth hinges on traffic volume or the mix shift between domestic and international travelers. A strong dollar can also significantly boost fees in local currency.

iii. Non-Aeronautical Fees

Next, as passengers disembark and make their way through the terminal, they are greeted by duty-free shops and other retailers, restaurants, and advertisements. This part of the airport's revenue is more dynamic and less regulated, allowing the operator to experiment with pricing strategies to maximize profits. Here, again, international travelers tend to spend more than domestic ones.

The airport’s economic ecosystem extends beyond the terminal to include on-site hotels, which cater to the needs of travelers with unexpected layovers, and parking areas1, whose fees vary depending on the duration of the stay and proximity to the terminal. This source of income, being less discretionary than those from retail, are more stable and therefore advantageous to the operator.

As with aeronautical fees, the volume of traffic and mix shift to international travelers is important, but the operator can also increase non-aeronautical revenue through price realization or by offering more services.

Case Study: Aéroports de Paris (ADP) has been rolling out a new retail and hospitality brand called Extime, which aims to offer a “reinvented airport experience” in restricted areas. From what I gather, it takes its inspiration from old-world aesthetic and comes with its own loyalty program. So far it seems to be working: during full-year 2023 results conference call, CEO Augustin de Romanet said,

“All in all, we can see that this strategy is already producing very good results. Spend per PAX in Paris reached EUR 30.6 in 2023, which is 12% higher than in '22 and 30% higher than in 2019. And if I can add, 90% higher than in 2012, because in 2012, we were at EUR 16 per PAX. So it's very promising.”

ADP aims to eventually export the Extime concept to its other airports, including Antalya Airport in Turkey.

iv. The Impact of Tourism

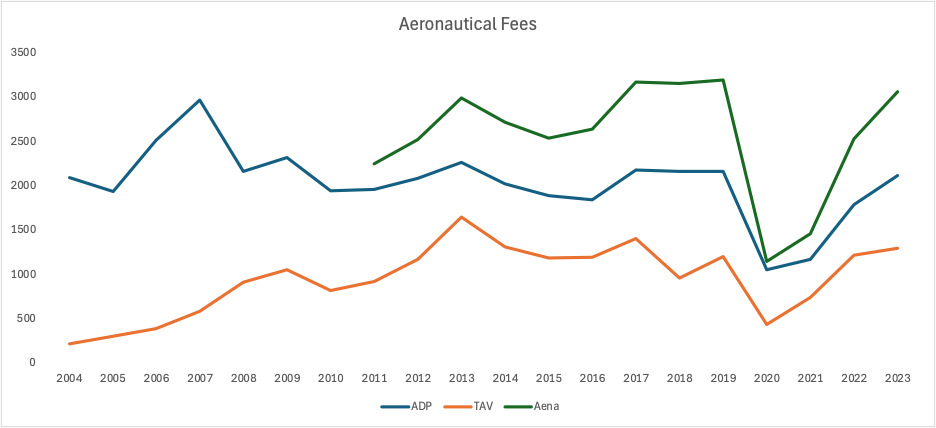

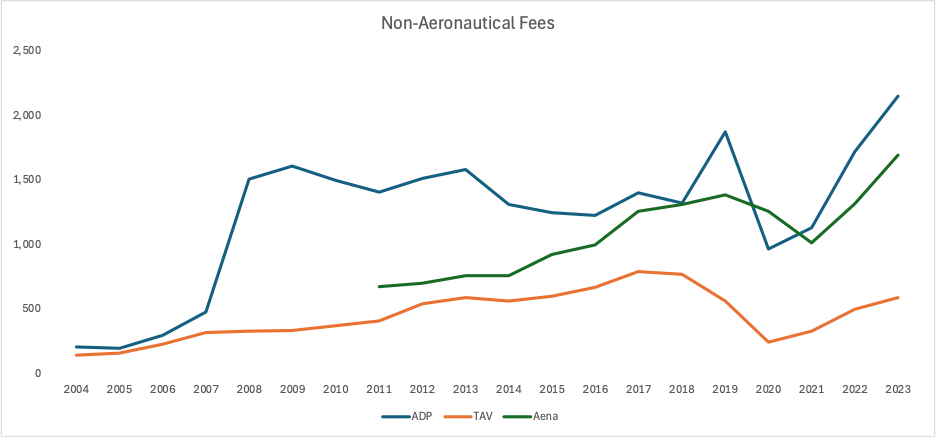

Here are the segmented results for ADP, TAV, and AENA:

As we can see, revenues for aeronautical are still below pre-covid levels and generally on a flat or down-trend, whereas non-aeronautical for ADP and Aena have surpassed their previous peaks. In terms of CAGR, since 2013:

Considering GDP growth and adjusting for inflation, it's evident that revenue growth is nothing to write home about—though Aena does stand above the rest.

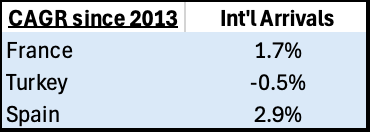

Now let’s compare these figures to tourism traffic. ADP’s revenues mostly come from France, TAV’s from Turkey, and Aena’s from Spain. So we can compare revenue growth to international arrivals to those countries:

This is pretty good evidence that non-aeronautical revenue growth corresponds (and is extremely sensitive) to international tourism.

v. The Mexican Difference

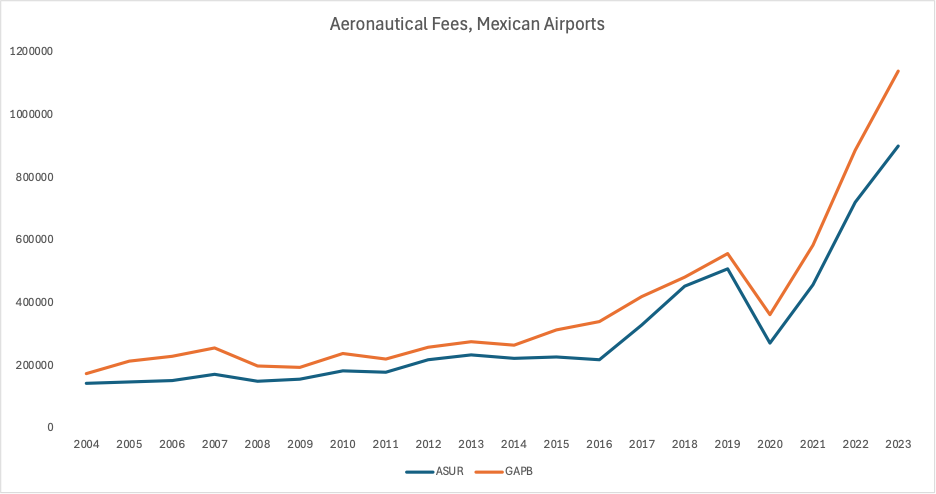

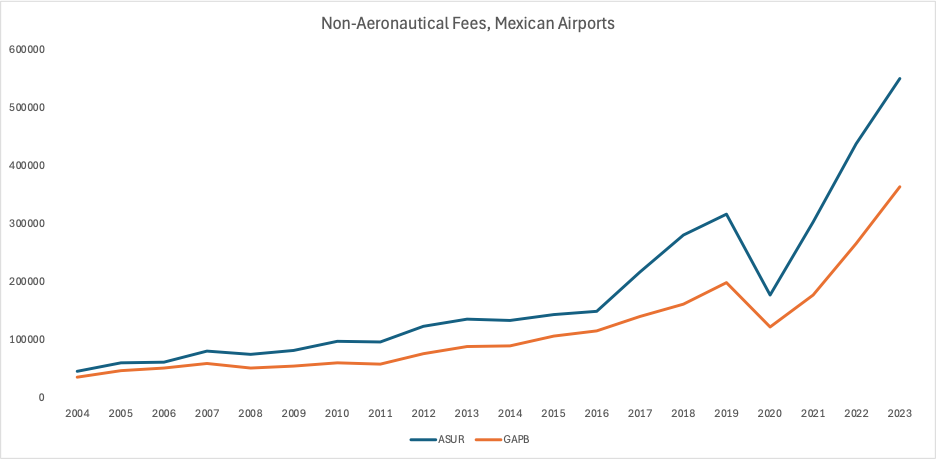

Both Mexican airports, ASUR and GAPB, have been allowed to raise their aeronautical fees at much higher rates.

For comparison, tourism’s CAGR to Mexico since 2013 has also been higher, at 5.7%.

Why has the Mexican government allowed growth in aeronautical fees to be so much higher than in other countries? For one, the maximum tariff is adjusted annually based on the Mexican Producer Price Index (PPI), excluding petroleum. There is a process to increase rates, which can take 3-4 months, unlike in France where rate adjustments seem to be at regulator’s discretion.

Additionally, if Mexican GDP drops by more than 5% in a year and this negatively impacts traffic, concession titles allow the operator to request an extraordinary tariff revision. In April 2021, for example, the revision process took effect, resulting in a 17% increase in aeronautical fees for ASUR.

The caveat here is that Mexican operators need to pay a concession fee back to the government (this seems to be common in non-OECD countries). So: the body that is responsible for regulating how much operators are allowed to charge airlines essentially takes a cut of the fee—quite a scheme! What could possibly go wrong? 😂

vi. Consumables

Airport terminals need constant upgrading.

The first expenses that the operator will incur are what are called consumables—everything from construction materials to smaller supplies necessary for day-to-day operations on site, including cost of fuel. Whether the responsibility for covering such expenses falls on the airport or on the client (i.e. government) is determined by the specifics of the contract agreed upon by both parties.

Payment terms for infrastructure projects typically follow a lump sum (fixed price) model, with disbursement of the stipulated price in regular monthly installments over the lifetime of the project, to provide predictable cash flow. However, a reimbursable (cost-plus) agreement is also possible, where the contractor is paid for all project-related expenses plus an additional fee or profit.

Here is Vinci in their Q4 2023 call, summing up their renewed focus on the latter:

We are now aware that the bottleneck is our ability to do the work, and there are some contracts that we shouldn't even consider. The Ukraine war broke out two years ago, and a month after that, we all decided to stop answering… fixed-cost contracts. That's selectivity. Some people go forward with these, some people don't. But when you do… it's much easier to manage increases in cost, because we're not bearing the risk entirely for that. It's shared with the client. So that's the kind of selectivity in contract selection that means that we're not just pushing for revenue, but the revenue still goes up."

In such cases, consumables are listed on the income statement, but it’s an expense that is reimbursed and essentially EBITDA-neutral. Gross profits, if measured as revenues minus consumables, are therefore only relevant for those operators working exclusively on a lump sum basis.

vii. Other Operating Expenses

It is more common for operators to treat EBITDA margins as gross margins. To get to EBITDA we have to deal with some other operating expenses:

Salaries — Sensitive to wage inflation, strong unions, and changes to labor laws.

Concession fees — As discussed above.

Subcontracting fees — Larger companies like Vinci have their own in-house construction division, and so have no need to hire subcontractors. There are both advantages and disadvantages to this. On the positive side, it enables Vinci to capitalize on the division’s expertise, positioning it to compete for projects that demand advanced know-how and benefiting from lower funding costs for the group, both of which bolster profit margins. On the downside, Vinci incurs greater operational risk that is not shared with the subcontractor.

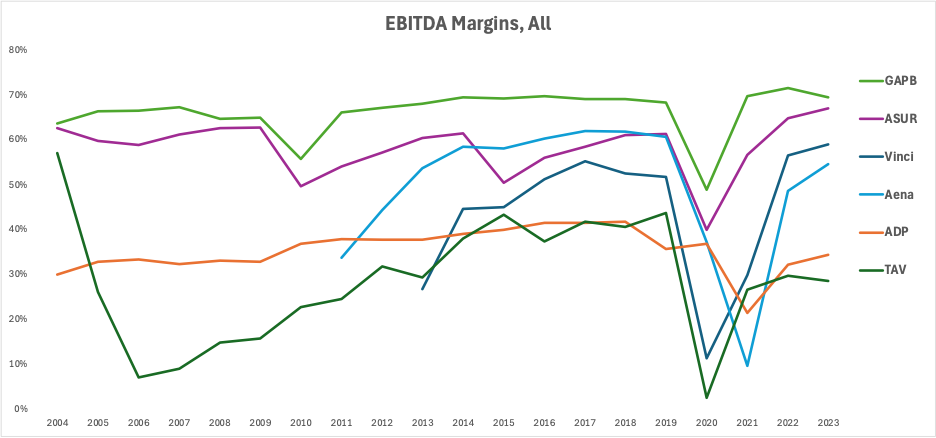

Here is a comparison of the EBITDA margins of all the companies.

The graph is a bit over-crowded but we can see that the Mexican operators—for reasons outlined above—have higher margins. Next comes Vinci (data only from their airports division), followed by Aena. Vinci benefits from diversification. Aena has seen strong growth in international tourism.

Last is ADP, which has suffered from stringent regulations on its fees, and TAV, which has seen a lack of growth in international tourism (exacerbated recently by the Ukraine war which has curtailed Russian tourists to the region).

viii. Model

In another post, we’ll be looking at the other two stages in the business cycle. We have a full DCF model available for Vinci, which is a company we like. Message us for details if interested in knowing more.

The content provided by Reveles Research, LLC, including all materials on this website and in any other communication from its author, is strictly for informational and educational purposes. It is not intended to be, and should not be interpreted as, investment, legal, or any other type of advice. Readers are encouraged to conduct their own research and due diligence. It's important to remember that investment decisions should be tailored to an individual's specific financial situation, goals, and risk tolerance.

Parking fees can also be regulated and considered aeronautical, depending on the jurisdiction.